Création de société en Suisse

Délai de création : 18 jours

Délai de création : 18 jours

Sociétés pré-constituées : Non

Sociétés pré-constituées : Non

Comptabilité : Obligatoire

Comptabilité : Obligatoire

Secrétariat : Obligatoire

Secrétariat : Obligatoire

Actionnariat anonyme : Oui

Actionnariat anonyme : Oui

Directeur nominé : Oui, sur demande

Directeur nominé : Oui, sur demande

Impot: 12%

- Suisse

- Les cantons Suisses

- Fiscalité et comptabilité

- S’installer

- Activité économique

- Marché et Législation

- Secret bancaire

Présentation de la Suisse

Pays de presque 8 millions d’habitants d’Europe occidentale, situé entre la France, l’Allemagne, l’Italie, l’Autriche et le Liechtenstein, la Suisse possède une facette multiculturelle issue de sa position géographique. Les langues nationales sont l’allemand, le français, l’italien et le romanche. Caractérisé par sa grande neutralité politique et militaire, le pays se compose de 26 cantons.

La Suisse : une place onshore

La Suisse est composée de plusieurs cantons qui appliquent indépendant leur taux d’imposition sur les sociétés. On considère la Suisse comme une place Onshore à faible fiscalité notamment car les sociétés enregistrées dans le canton d’Obwald paieront 12,66% d’impôt seulement. Les sociétés peuvent être également constituées à Lausanne, Genève, Zug, Zurich mais l’imposition sera plus élevée (voir notre page fiscalité et comptabilité).

Bon à savoir en Suisse

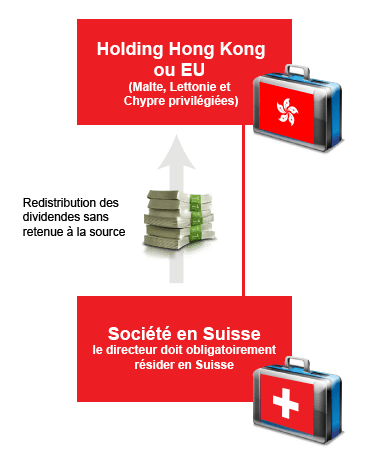

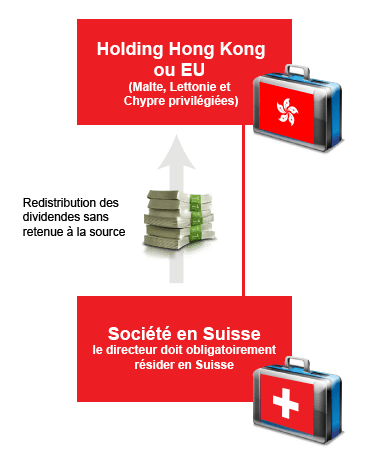

La Suisse dispose de nombreux cantons avec une fiscalité différente pour chacun d’entre eux. C’est l’un des rares pays permettant encore des actions anonymes au porteur dans la S.A, ce qui nécessite un capital de 100.000 CHF – les SARL n’offrant pas d’anonymat sauf par détention des parts au travers d’un trust nécessitant un capital de 20.000 CHF -. La constitution d’une société Suisse est recommandée avec une holding à Hong-Kong afin d’y faire remonter les dividendes compte tenu des accords signés entre la Suisse et Hong Kong. La création d’une société en Suisse nécessite de disposer d’un directeur résident suisse ou de nationalité suisse.

Les différents types de sociétés en Suisse

L’implantation en Suisse demande un délai de 7 jours et 6 procédures différentes.

| Types de société | Capital | Nombre d’associés |

|---|---|---|

| SARL (GmBH) | 20 000 CHF au minimum | Pas de minimum, responsabilité limitée au capital |

| Société Anonyme (AG) | 100 000 CHF minimum | Pas de minimum, responsabilité limitée aux apports |

L’administration et l’actionnariat d’une société en Suisse.

Le directeur d’une société suisse doit obligatoirement être résident ou de nationalité suisse et sa responsabilité est engagée. Il est donc possible d’avoir un administrateur nominee dans le cadre d’un mandat d’administration de société. L’actionnariat d’une société est public dans les SARL (GmBH) et au porteur, donc anonyme dans les S.A – Sociétés Anonymes (AG).

Il est recommandé de détenir les parts d’une sociétés suisse au travers d’une holding à Hong Kong ou en Europe afin d’éviter la retenue à la source de 35% (voir comptabilité et fiscalité)

La carte des cantons suisses

Les cantons suisses et leur fiscalité

Il existe 26 cantons en Suisse, officiellement appelés les États fédérés de la Confédération suisse. Ils fonctionnent de manière indépendante et possèdent chacun leur constitution et leur parlement. L’ensemble de ces cantons se réunit au Conseil des États pour agir à un échelon national.

La présence de ces nombreux cantons possède donc, entre autres, une influence sur la fiscalité du pays qui ne peut ainsi pas être définie de manière globale. En effet, chaque canton est libre d’établir ses propres normes d’imposition sur les particuliers et sur les sociétés. L’impôt est alors composé de trois « sous-impôts », dont les montants diffèrent selon les cantons :

- l’impôt fédéral, qui est identique à tous les cantons car fixé au niveau national

- l’impôt cantonal, qui est choisi par les cantons eux-mêmes

- l’impôt communal qui peut être modifié par chaque commune suisse (2 485 communes recensées en 2012)

Ainsi, de nombreux cantons attirent les entreprises, à l’image de Zoug qui comptait en 2012 plus 200 000 sociétés. La majorité des affaires se partage entre les cantons de Lugano, Lausanne, Zurich, Genève, Zoug et Obwald. Ce dernier est d’ailleurs, pour rappel, le canton proposant la fiscalité sur les entreprises la plus faible.

Les différents taux d’imposition en Suisse

L’impôt sur les sociétés varie d’un canton à un autre car il est composé de trois taxes : fédérale, cantonale et communale. Chaque canton possède donc sa propre fiscalité applicable aux entreprises, puisque chacun d’entre eux fixe le niveau de ses taxes. L’impôt sur les sociétés varie donc entre 12,66% et 24,43%.

Le canton d’Obwald est le plus attrayant fiscalement, alors que Genève (qui sert souvent de référence) possède une taxe de 24,17% sur les entreprises. Il est donc important de se renseigner sur les impôts cantonaux pour choisir la meilleure destination.

Sur ce montant à payer peuvent être déduits les dépréciations, les dépenses professionnelles, les taxes douanières et les pertes peuvent être reportées sur les exercices futurs. La TVA suisse est de 8% avec des taux de 2,5% ou de 3,8% pour certaines catégories de produits. L’impôt sur le revenu est fixe, mais il varie selon les régions de Suisse.

La France et la Suisse ont signé deux conventions de non double imposition en 1953 et en 1966.

La fiscalité sur les dividendes de sociétés Suisses.

Le schéma ci dessous présente une solution optimale de constitution de société en Suisse. Il montre une société suisse enregistrée dans le canton d’Obwald (profitant du plus bas taux d’imposition à 16%), détenue par une société holding permettant une distribution de dividendes sans retenue à la source de 35% tel que Hong Kong, Malte, Chypre ou La Lettonie.*

La retenue à la source s’applique en Suisse à tout paiement de dividendes à un non-résident suisse à l’exception des pays de la zone européenne, et de Hong Kong sur lequel se porte notre choix.

* MBS Corporate Services décline toute responsabilité en cas de changement dans la législation ou en cas d’usage d’un montage sans avis juridique préalable. Ces schéma et avis sont donnés à titre d’information et ne peuvent engager la responsabilité de l’auteur.

Attention : Le terme « montage offshore » peut être considéré à certains égards comme une fraude fiscale, une évasion fiscale ou un abus de droit. Le schéma ci-dessus peut être illégal dans certains pays et donne un aperçu rapide de pratiques internationales, il ne peut aucunement être considéré comme définitif ou applicable sur la base de l’illustration présentée. Si vous souhaitez réaliser un tel montage vous devez obligatoirement consulter un conseiller qualifié.

L’essentiel de la comptabilité en Suisse

En Suisse, l’année fiscale est comprise entre le 1er janvier et le 31 décembre. Les entreprises doivent tenir les livres de comptes en respectant le Code Suisse des Obligations, ainsi qu’un bilan, un état des résultats et un état des biens, le tout en CHF.

Le bilan financier doit être publié chaque année. Un commissaire aux comptes doit également réaliser un audit financier de la société.

Liens :

Taxes Suisses

Office Fédéral Suisse des Finances

Convention de non double imposition de 1953

Convention de non double imposition de 1966

S’installer en Suisse : Livret B/C

Pour un séjour en Suisse d’une durée supérieure à trois mois, une autorisation est nécessaire et s’obtient auprès des offices cantonaux de migration. Un livret peut alors être attribué à un étranger souhaitant résider dans le pays pour une longue durée et dépend de sa situation et de son activité en Suisse. Dans le cadre d’une implantation onshore, deux livrets sont conseillés :

- le Livret B : il est délivré pour un étranger résidant à l’année et exerçant ou non une activité en Suisse.

- le Livret C : il est destiné aux étrangers dits « établis », c’est à dire ayant vécu en Suisse pendant 5 ou 10 ans et ayant reçu une autorisation d’établissement. Ce livret est à durée indéterminée.

Le forfait fiscal

Le forfait fiscal est une forme particulière d’impôt sur les personnes, uniquement réservé aux résidents n’ayant pas la nationalité suisse. Comme son nom l’indique, il s’agit d’un forfait, c’est à dire d’un montant fixe d’impôt à payer chaque année, sans aucun lien avec les revenus ou la richesse de l’individu. Plutôt qu’un impôt sur le revenu, il s’agit d’un impôt sur les dépenses, qui sont en réalités estimées sur le loyer annuel payé par le résident étranger. En général, le forfait fiscal correspond à 5 fois le loyer annuel.

Les conditions nécessaires pour prétendre au forfait fiscal sont les suivantes :

- avoir un passeport de l’Union Européenne

- n’exercer aucune activité professionnelle en Suisse

- posséder un revenu annuel supérieur à 50 000 CHF

- résider en Suisse au moins 180 jours par an

Les citoyens suisses ne peuvent donc pas bénéficier de ce forfait fiscal et sont soumis à l’impôt sur le revenu « classique », qui varie selon les cantons :

| Cantons | Taux d’imposition |

|---|---|

| Jura | 42,28% |

| Bâle-Champagne | 40,78% |

| Genève | 40,68% |

| Berne | 40,44% |

| Vaud | 39,4% |

| Zurich | 39,18% |

| Tessin | 39,11% |

| Bâle-Ville | 37,58% |

| Neuchâtel | 37,35% |

| Valais | 34,97% |

| Soleure | 34,84% |

| Fribourg | 34,54% |

| Argovie | 34,2% |

| Cantons | Taux d’imposition |

|---|---|

| Thurgovie | 33,92% |

| Glaris | 33,83% |

| Saint-Gall | 32,62% |

| Schaffhouse | 32,27% |

| Grisons | 31,88% |

| Lucerne | 31,19% |

| Appenzell Rhodes-Extérieures | 30,17% |

| Appenzell Rhodes-Intérieures | 30,17% |

| Uri | 25,43% |

| Zoug | 23,82% |

| Schwytz | 23,15% |

| Obwald | 22,42% |

| Nidwald | 26,13% |

Les résidents de l’UE et les non-résidents

Les modalités de séjour et de travail des étrangers en Suisse varient selon leur provenance :

- Les ressortissants de l’Union Européenne ou de l’Association Européenne de Libre-Echange peuvent séjourner en Suisse sans aucune autorisation pour un délai maximum de trois mois. Hormis pour les ressortissants de ce que l’on appelle l’UE-8 (pays d’Europe de l’est intégrés en 2004), la libre circulation des personnes est totale (l’UE-8 possède encore quelques restrictions jusqu’en 2014). Les personnes bénéficiant de la libre circulation peuvent venir travailler en Suisse sans permis particulier (mais doivent quand même avoir une autorisation de séjour si ce dernier dépasse les trois mois).

- Les non-ressortissants de l’UE ou de l’AELE doivent quant à eux posséder une autorisation de travail et de séjour pour effectuer des activités en Suisse. Cependant, leurs conditions d’entrée et de circulation se sont nettement améliorées ces dernières années pour favoriser la flexibilité de l’économie. Ainsi, un étranger possédant une autorisation de séjour peut exercer une activité professionnelle en Suisse sans autre déclaration préalable. Il existe de nombreuses autorisations comme les livrets B, C et L, l’autorisation frontalière, l’autorisation de courte durée, l’autorisation de stagiaire,…

Passeport : devenir citoyen suisse

- avoir résidé au moins 12 ans en Suisse (les années comptent double entre 10 et 20 ans)

- être intégré à la communauté suisse et être familiarisé avec les coutumes et traditions du pays

- se conformer à la justice suisse

- ne présenter aucun danger pour la sécurité intérieure ou extérieure de la Suisse

La naturalisation du conjoint peut-être facilitée si le couple réside depuis au moins cinq ans en Suisse et est marié depuis au moins trois ans. Pour les enfants, si l’un des parents est naturalisé suisse, la naturalisation est elle aussi simplifiée. Pour rappel, être citoyen Suisse ne donne plus droit au forfait fiscal.

Vivre en Suisse

Plus de 6500 entreprises étrangères sont actuellement installées en Suisse et font régulièrement appel à des employés étrangers, d’où des services de logement et d’intégration nombreux (agences de relogement, associations d’expatriés,…), sans parler du fait que la Suisse est une destination de référence pour l’expatriation fiscale. La location d’un appartement est soumise à un formulaire à remplir par le futur locataire comprenant l’âge, l’état civil, la profession, le nombre d’enfant, le type d’autorisation de séjour, l’employeur et le salaire. Un extrait du Registre des Poursuites (à récupérer auprès de l’Office des Poursuites de la commune) est également demandé pour vérifier la solvabilité du locataire.

Succession et héritage

L’un des autres grands avantages de la Suisse est son système de succession : dans le pays, l’héritage n’est pas taxé. De nombreuses personnes choisissent ainsi de finir leur vie en Suisse pour léguer à leurs héritiers tout leur patrimoine, sans passer par la case des impôts. Cependant, à partir du 1er janvier 2014, ce constat ne sera plus valable : si une personne résidant en Suisse décède et que ses héritiers vivent en France, ces derniers seront taxés sur leur héritage selon les normes fiscales françaises.

La juridiction en détail

La Suisse est réputée pour l’efficacité de son économie et le niveau de vie élevé de ses habitants, ainsi que pour son système de santé et d’éducation, faisant partie des meilleurs résultats européens. Néanmoins, la crise mondiale de 2008 n’a pas contourné le pays qui a vu sa croissance fortement ralentir avant de lentement se redresser grâce à la Demande interne. Pour 2013, elle est estimée à 1,4%.

Le secteur agricole de la Suisse est réduit à 1% du PIB, une situation en partie provoquée par le territoire naturel du pays, dont seulement 10% de la surface est cultivable. La production se concentre notamment sur les produits laitiers et l’élevage, bien que l’agriculture biologique connaisse actuellement une phase de croissance. L’industrie du pays, comme son économie, est aussi célèbre dans le monde entier avec les produits chimiques et pharmaceutiques de Bâle.

Mais ce sont surtout les produits manufacturés de grande qualité (montres, moteurs, turbines, générateurs,…) qui ont dressé la réputation du secteur industriel suisse. Enfin, le tertiaire représente plus de 70% du PIB et pèse presque autant sur les emplois de la population active. Les domaines des services les plus actifs sont les banques, les assurances et les transports, ainsi que le tourisme, lui aussi très dynamique.

Les échanges commerciaux internationaux sont très importants pour l’économie de la Suisse qui est un pays très ouvert sur le monde. Sa balance commerciale est de loin excédentaire, et ses partenaires principaux sont l’Union Européenne et les États-Unis.

Les avantages de l’investissement :

- bonne situation géographique

- très bonnes infrastructures

- fiscalité attractive

- facilité à introduire des produits high-tech

- main d’œuvre très qualifiée

- pays très axé sur la R&D

- fonds d’investissement de capitaux les plus hauts d’Europe

Les points faibles :

- marché fortement concurrentiel

- règlementations strictes sur les entreprises

Les investissements étrangers sont très bien accueillis en Suisse, chaque canton étant libre de les recevoir comme il l’entend. De nombreux avantages fiscaux leur sont ainsi procurés (10 ans sans charges, par exemple, pour quelques cantons).

L’accès et le fonctionnement du marché

La Suisse est membre de l’OMC, de l’OCDE et de l’Association de Libre Commerce Européenne. Elle est aussi signataire du Protocole de Kyoto, de la Convention de Washington, de la Convention de Bâle, du Protocole de Montréal et de l’Accord International sur le café de 2001.

Les normes d’importation suisses sont très strictes et, si la possession de licences n’est pas obligatoire pour commercer, certains produits en nécessitent malgré tout. Des quotas sont même attribués à des catégories de marchandises comme l’agriculture biotechnologique. Toutefois, le commerce avec les pays de l’Union Européenne est très libéralisé.

Les produits importés doivent être présentés à un bureau des douanes dans des délais variant selon le mode de transport utilisé pour faire voyager les marchandises. Beaucoup de sociétés font appel à des transitaires, qui font office de transporteurs et d’agents douaniers. Les frais de douanes sont en général de 5,5% en Suisse, bien que cette valeur puisse évoluer selon les marchandises.

Le milieu de la distribution est majoritairement représenté par les enseignes de supermarchés et de magasins discounts. La manufacture est très dynamique en Suisse puisqu’elle représente 76 000 entreprises et 42% des exportations. Les secteurs de la mécanique, de l’électrique et du métal sont aussi très importants.

Liens :

Administration Fédérale des Douanes

Types de société

L’administration et l’actionnariat d’une société en Suisse.

Le directeur d’une société suisse doit obligatoirement être résident ou de nationalité suisse et sa responsabilité est engagée. Il est donc possible d’avoir un administrateur nominee dans le cadre d’un mandat d’administration de société. L’actionnariat d’une société est public dans les SARL (GmBH) et au porteur, donc anonyme dans les S.A – Sociétés Anonymes (AG).

Il est recommandé de détenir les parts d’une sociétés suisse au travers d’une holding à Hong Kong ou en Europe afin d’éviter la retenue à la source de 35%

Liens :

Registre des Entreprises

Chambre des Notaires

La carte des cantons suisses

Les cantons suisses et leur fiscalité

Il existe 26 cantons en Suisse, officiellement appelés les États fédérés de la Confédération suisse. Ils fonctionnent de manière indépendante et possèdent chacun leur constitution et leur parlement. L’ensemble de ces cantons se réunit au Conseil des États pour agir à un échelon national.

La présence de ces nombreux cantons possède donc, entre autres, une influence sur la fiscalité du pays qui ne peut ainsi pas être définie de manière globale. En effet, chaque canton est libre d’établir ses propres normes d’imposition sur les particuliers et sur les sociétés. L’impôt est alors composé de trois « sous-impôts », dont les montants diffèrent selon les cantons :

- l’impôt fédéral, qui est identique à tous les cantons car fixé au niveau national

- l’impôt cantonal, qui est choisi par les cantons eux-mêmes

- l’impôt communal qui peut être modifié par chaque commune suisse (2 485 communes recensées en 2012)

Ainsi, de nombreux cantons attirent les entreprises, à l’image de Zoug qui comptait en 2012 plus 200 000 sociétés. La majorité des affaires se partage entre les cantons de Lugano, Lausanne, Zurich, Genève, Zoug et Obwald. Ce dernier est d’ailleurs, pour rappel, le canton proposant la fiscalité sur les entreprises la plus faible.

delete Title ContentLes différents taux d’imposition en Suisse

L’impôt sur les sociétés varie d’un canton à un autre car il est composé de trois taxes : fédérale, cantonale et communale. Chaque canton possède donc sa propre fiscalité applicable aux entreprises, puisque chacun d’entre eux fixe le niveau de ses taxes. L’impôt sur les sociétés varie donc entre 12,66% et 24,43%.

Le canton d’Obwald est le plus attrayant fiscalement, alors que Genève (qui sert souvent de référence) possède une taxe de 24,17% sur les entreprises. Il est donc important de se renseigner sur les impôts cantonaux pour choisir la meilleure destination.

Sur ce montant à payer peuvent être déduits les dépréciations, les dépenses professionnelles, les taxes douanières et les pertes peuvent être reportées sur les exercices futurs. La TVA suisse est de 8% avec des taux de 2,5% ou de 3,8% pour certaines catégories de produits. L’impôt sur le revenu est fixe, mais il varie selon les régions de Suisse.

La France et la Suisse ont signé deux conventions de non double imposition en 1953 et en 1966.

La fiscalité sur les dividendes de sociétés Suisses.

Le schéma ci dessous présente une solution optimale de constitution de société en Suisse. Il montre une société suisse enregistrée dans le canton d’Obwald (profitant du plus bas taux d’imposition à 16%), détenue par une société holding permettant une distribution de dividendes sans retenue à la source de 35% tel que Hong Kong, Malte, Chypre ou La Lettonie.*

La retenue à la source s’applique en Suisse à tout paiement de dividendes à un non-résident suisse à l’exception des pays de la zone européenne, et de Hong Kong sur lequel se porte notre choix.

* MBS Corporate Services décline toute responsabilité en cas de changement dans la législation ou en cas d’usage d’un montage sans avis juridique préalable. Ces schéma et avis sont donnés à titre d’information et ne peuvent engager la responsabilité de l’auteur.

Attention : Le terme « montage offshore » peut être considéré à certains égards comme une fraude fiscale, une évasion fiscale ou un abus de droit. Le schéma ci-dessus peut être illégal dans certains pays et donne un aperçu rapide de pratiques internationales, il ne peut aucunement être considéré comme définitif ou applicable sur la base de l’illustration présentée. Si vous souhaitez réaliser un tel montage vous devez obligatoirement consulter un conseiller qualifié.

L’essentiel de la comptabilité en Suisse

En Suisse, l’année fiscale est comprise entre le 1er janvier et le 31 décembre. Les entreprises doivent tenir les livres de comptes en respectant le Code Suisse des Obligations, ainsi qu’un bilan, un état des résultats et un état des biens, le tout en CHF.

Le bilan financier doit être publié chaque année. Un commissaire aux comptes doit également réaliser un audit financier de la société.

Liens :

Taxes Suisses

Office Fédéral Suisse des Finances

Convention de non double imposition de 1953

Convention de non double imposition de 1966

S’installer en Suisse : Livret B/C

Pour un séjour en Suisse d’une durée supérieure à trois mois, une autorisation est nécessaire et s’obtient auprès des offices cantonaux de migration. Un livret peut alors être attribué à un étranger souhaitant résider dans le pays pour une longue durée et dépend de sa situation et de son activité en Suisse. Dans le cadre d’une implantation onshore, deux livrets sont conseillés :

- le Livret B : il est délivré pour un étranger résidant à l’année et exerçant ou non une activité en Suisse.

- le Livret C : il est destiné aux étrangers dits « établis », c’est à dire ayant vécu en Suisse pendant 5 ou 10 ans et ayant reçu une autorisation d’établissement. Ce livret est à durée indéterminée.

Le forfait fiscal

Le forfait fiscal est une forme particulière d’impôt sur les personnes, uniquement réservé aux résidents n’ayant pas la nationalité suisse. Comme son nom l’indique, il s’agit d’un forfait, c’est à dire d’un montant fixe d’impôt à payer chaque année, sans aucun lien avec les revenus ou la richesse de l’individu. Plutôt qu’un impôt sur le revenu, il s’agit d’un impôt sur les dépenses, qui sont en réalités estimées sur le loyer annuel payé par le résident étranger. En général, le forfait fiscal correspond à 5 fois le loyer annuel.

Les conditions nécessaires pour prétendre au forfait fiscal sont les suivantes :

- avoir un passeport de l’Union Européenne

- n’exercer aucune activité professionnelle en Suisse

- posséder un revenu annuel supérieur à 50 000 CHF

- résider en Suisse au moins 180 jours par an

Les citoyens suisses ne peuvent donc pas bénéficier de ce forfait fiscal et sont soumis à l’impôt sur le revenu « classique », qui varie selon les cantons :

| Cantons | Taux d’imposition |

|---|---|

| Jura | 42,28% |

| Bâle-Champagne | 40,78% |

| Genève | 40,68% |

| Berne | 40,44% |

| Vaud | 39,4% |

| Zurich | 39,18% |

| Tessin | 39,11% |

| Bâle-Ville | 37,58% |

| Neuchâtel | 37,35% |

| Valais | 34,97% |

| Soleure | 34,84% |

| Fribourg | 34,54% |

| Argovie | 34,2% |

| Cantons | Taux d’imposition |

|---|---|

| Thurgovie | 33,92% |

| Glaris | 33,83% |

| Saint-Gall | 32,62% |

| Schaffhouse | 32,27% |

| Grisons | 31,88% |

| Lucerne | 31,19% |

| Appenzell Rhodes-Extérieures | 30,17% |

| Appenzell Rhodes-Intérieures | 30,17% |

| Uri | 25,43% |

| Zoug | 23,82% |

| Schwytz | 23,15% |

| Obwald | 22,42% |

| Nidwald | 26,13% |

Les résidents de l’UE et les non-résidents

Les modalités de séjour et de travail des étrangers en Suisse varient selon leur provenance :

- Les ressortissants de l’Union Européenne ou de l’Association Européenne de Libre-Echange peuvent séjourner en Suisse sans aucune autorisation pour un délai maximum de trois mois. Hormis pour les ressortissants de ce que l’on appelle l’UE-8 (pays d’Europe de l’est intégrés en 2004), la libre circulation des personnes est totale (l’UE-8 possède encore quelques restrictions jusqu’en 2014). Les personnes bénéficiant de la libre circulation peuvent venir travailler en Suisse sans permis particulier (mais doivent quand même avoir une autorisation de séjour si ce dernier dépasse les trois mois).

- Les non-ressortissants de l’UE ou de l’AELE doivent quant à eux posséder une autorisation de travail et de séjour pour effectuer des activités en Suisse. Cependant, leurs conditions d’entrée et de circulation se sont nettement améliorées ces dernières années pour favoriser la flexibilité de l’économie. Ainsi, un étranger possédant une autorisation de séjour peut exercer une activité professionnelle en Suisse sans autre déclaration préalable. Il existe de nombreuses autorisations comme les livrets B, C et L, l’autorisation frontalière, l’autorisation de courte durée, l’autorisation de stagiaire,…

Passeport : devenir citoyen suisse

- avoir résidé au moins 12 ans en Suisse (les années comptent double entre 10 et 20 ans)

- être intégré à la communauté suisse et être familiarisé avec les coutumes et traditions du pays

- se conformer à la justice suisse

- ne présenter aucun danger pour la sécurité intérieure ou extérieure de la Suisse

La naturalisation du conjoint peut-être facilitée si le couple réside depuis au moins cinq ans en Suisse et est marié depuis au moins trois ans. Pour les enfants, si l’un des parents est naturalisé suisse, la naturalisation est elle aussi simplifiée. Pour rappel, être citoyen Suisse ne donne plus droit au forfait fiscal.

Vivre en Suisse

Plus de 6500 entreprises étrangères sont actuellement installées en Suisse et font régulièrement appel à des employés étrangers, d’où des services de logement et d’intégration nombreux (agences de relogement, associations d’expatriés,…), sans parler du fait que la Suisse est une destination de référence pour l’expatriation fiscale. La location d’un appartement est soumise à un formulaire à remplir par le futur locataire comprenant l’âge, l’état civil, la profession, le nombre d’enfant, le type d’autorisation de séjour, l’employeur et le salaire. Un extrait du Registre des Poursuites (à récupérer auprès de l’Office des Poursuites de la commune) est également demandé pour vérifier la solvabilité du locataire.

Succession et héritage

L’un des autres grands avantages de la Suisse est son système de succession : dans le pays, l’héritage n’est pas taxé. De nombreuses personnes choisissent ainsi de finir leur vie en Suisse pour léguer à leurs héritiers tout leur patrimoine, sans passer par la case des impôts. Cependant, à partir du 1er janvier 2014, ce constat ne sera plus valable : si une personne résidant en Suisse décède et que ses héritiers vivent en France, ces derniers seront taxés sur leur héritage selon les normes fiscales françaises.

delete Title ContentLa juridiction en détail

La Suisse est réputée pour l’efficacité de son économie et le niveau de vie élevé de ses habitants, ainsi que pour son système de santé et d’éducation, faisant partie des meilleurs résultats européens. Néanmoins, la crise mondiale de 2008 n’a pas contourné le pays qui a vu sa croissance fortement ralentir avant de lentement se redresser grâce à la Demande interne. Pour 2013, elle est estimée à 1,4%.

Le secteur agricole de la Suisse est réduit à 1% du PIB, une situation en partie provoquée par le territoire naturel du pays, dont seulement 10% de la surface est cultivable. La production se concentre notamment sur les produits laitiers et l’élevage, bien que l’agriculture biologique connaisse actuellement une phase de croissance. L’industrie du pays, comme son économie, est aussi célèbre dans le monde entier avec les produits chimiques et pharmaceutiques de Bâle.

Mais ce sont surtout les produits manufacturés de grande qualité (montres, moteurs, turbines, générateurs,…) qui ont dressé la réputation du secteur industriel suisse. Enfin, le tertiaire représente plus de 70% du PIB et pèse presque autant sur les emplois de la population active. Les domaines des services les plus actifs sont les banques, les assurances et les transports, ainsi que le tourisme, lui aussi très dynamique.

Les échanges commerciaux internationaux sont très importants pour l’économie de la Suisse qui est un pays très ouvert sur le monde. Sa balance commerciale est de loin excédentaire, et ses partenaires principaux sont l’Union Européenne et les États-Unis.

Les avantages de l’investissement :

- bonne situation géographique

- très bonnes infrastructures

- fiscalité attractive

- facilité à introduire des produits high-tech

- main d’œuvre très qualifiée

- pays très axé sur la R&D

- fonds d’investissement de capitaux les plus hauts d’Europe

Les points faibles :

- marché fortement concurrentiel

- règlementations strictes sur les entreprises

Les investissements étrangers sont très bien accueillis en Suisse, chaque canton étant libre de les recevoir comme il l’entend. De nombreux avantages fiscaux leur sont ainsi procurés (10 ans sans charges, par exemple, pour quelques cantons).

delete Title ContentL’accès et le fonctionnement du marché

La Suisse est membre de l’OMC, de l’OCDE et de l’Association de Libre Commerce Européenne. Elle est aussi signataire du Protocole de Kyoto, de la Convention de Washington, de la Convention de Bâle, du Protocole de Montréal et de l’Accord International sur le café de 2001.

Les normes d’importation suisses sont très strictes et, si la possession de licences n’est pas obligatoire pour commercer, certains produits en nécessitent malgré tout. Des quotas sont même attribués à des catégories de marchandises comme l’agriculture biotechnologique. Toutefois, le commerce avec les pays de l’Union Européenne est très libéralisé.

Les produits importés doivent être présentés à un bureau des douanes dans des délais variant selon le mode de transport utilisé pour faire voyager les marchandises. Beaucoup de sociétés font appel à des transitaires, qui font office de transporteurs et d’agents douaniers. Les frais de douanes sont en général de 5,5% en Suisse, bien que cette valeur puisse évoluer selon les marchandises.

Le milieu de la distribution est majoritairement représenté par les enseignes de supermarchés et de magasins discounts. La manufacture est très dynamique en Suisse puisqu’elle représente 76 000 entreprises et 42% des exportations. Les secteurs de la mécanique, de l’électrique et du métal sont aussi très importants.

Liens :

Administration Fédérale des Douanes

Secrétariat d’Etat à l’Economie

Office Fédéral des Transports

Fédération Suisse du Commerce et de l’Industrie

La législation du travail

La durée maximale de travail par semaine varie selon le type d’employés : 45 heures pour les techniciens et chercheurs, et 50 heures pour tous les autres. L’âge de départ à la retraite est fixé à 65 ans, et s’il n’existe aucun salaire minimum dans le pays, des protections ont toutefois été mises en place pour éviter une concurrence faussée. Les cotisations sociales s’élèvent à 5,05%, pour les employeurs comme pour les employés.

La notion de syndicat en Suisse existe mais, contrairement à d’autres pays comme la France, elle ne possède pas un poids très influent. En effet, les négociations sont préférées aux grèves. 25% des employés sont cependant syndiqués.

La propriété intellectuelle

| Type de droits | Texte de loi | Validité de la protection | Accords signés |

|---|---|---|---|

| Brevets | Loi sur les brevets d’invention de 1954 | 20 ans | - Traité de Coopération en matière de Brevets - Arrangement de Strasbourg sur la classification |

| Marques | Loi sur les protections des marques | 10 ans renouvelables | - Arrangement de Nice sur la classification internationale des produits et services - Arrangement de Madrid sur l’enregistrement des marques |

| Design | Loi fédérale sur la protection du design | 5 ans renouvelables jusqu’à 25 ans | |

| Droits de reproduction | Loi fédérale sur les droits d’auteur | 50 à 70 ans après la mort de l’auteur | - Convention de Berne pour la protection des œuvres littéraires et artistiques - Convention de Rome pour la protection des artistes interprètes - Traité de l’OMPI sur les interprétations, exécutions et les phonogrammes - Traité de l’OMPI sur le droit d’auteur - Convention pour la protection des producteurs de phonogrammes |

| Modèles industriels | Statut fédéral sur la protection des designs et modèles industriels | 5 ans renouvelables jusqu’à 25 ans |

Liens :

Fédération des Entreprises Romandes

Union Syndicale Suisse

Les données politiques

Le pouvoir exécutif suisse est détenu par le Conseil Fédéral composé de 7 membres élus par le Parlement pour quatre ans. Le Président suisse (actuellement Ueli Maurer) possède une fonction simplement honorifique ; le poste est occupé par l’un des membres du Conseil Fédéral et change tous les ans.

Le pouvoir législatif est représenté par le Parlement, ou Assemblée Fédérale, composé du Conseil d’Etat (46 membres nommés pour quatre ans), et du Conseil National et ses 200 membres élus au suffrage universel pour quatre ans également.

Au niveau des partis politiques, on distingue principalement le Parti Populaire Suisse, le Parti Social-Démocrate, le Parti Chrétien Démocrate et le Parti Écologique.

delete Titlehttp://www.seco.admin.ch/index.html?lang=fr" target="_blank" rel="nofollow">Secrétariat d’Etat à l’Economie

Office Fédéral des Transports

Fédération Suisse du Commerce et de l’Industrie

La législation du travail

La durée maximale de travail par semaine varie selon le type d’employés : 45 heures pour les techniciens et chercheurs, et 50 heures pour tous les autres. L’âge de départ à la retraite est fixé à 65 ans, et s’il n’existe aucun salaire minimum dans le pays, des protections ont toutefois été mises en place pour éviter une concurrence faussée. Les cotisations sociales s’élèvent à 5,05%, pour les employeurs comme pour les employés.

La notion de syndicat en Suisse existe mais, contrairement à d’autres pays comme la France, elle ne possède pas un poids très influent. En effet, les négociations sont préférées aux grèves. 25% des employés sont cependant syndiqués.

La propriété intellectuelle

| Type de droits | Texte de loi | Validité de la protection | Accords signés |

|---|---|---|---|

| Brevets | Loi sur les brevets d’invention de 1954 | 20 ans | - Traité de Coopération en matière de Brevets - Arrangement de Strasbourg sur la classification |

| Marques | Loi sur les protections des marques | 10 ans renouvelables | - Arrangement de Nice sur la classification internationale des produits et services - Arrangement de Madrid sur l’enregistrement des marques |

| Design | Loi fédérale sur la protection du design | 5 ans renouvelables jusqu’à 25 ans | |

| Droits de reproduction | Loi fédérale sur les droits d’auteur | 50 à 70 ans après la mort de l’auteur | - Convention de Berne pour la protection des œuvres littéraires et artistiques - Convention de Rome pour la protection des artistes interprètes - Traité de l’OMPI sur les interprétations, exécutions et les phonogrammes - Traité de l’OMPI sur le droit d’auteur - Convention pour la protection des producteurs de phonogrammes |

| Modèles industriels | Statut fédéral sur la protection des designs et modèles industriels | 5 ans renouvelables jusqu’à 25 ans |

Liens :

Fédération des Entreprises Romandes

Union Syndicale Suisse

Les données politiques

Le pouvoir exécutif suisse est détenu par le Conseil Fédéral composé de 7 membres élus par le Parlement pour quatre ans. Le Président suisse (actuellement Ueli Maurer) possède une fonction simplement honorifique ; le poste est occupé par l’un des membres du Conseil Fédéral et change tous les ans.

Le pouvoir législatif est représenté par le Parlement, ou Assemblée Fédérale, composé du Conseil d’Etat (46 membres nommés pour quatre ans), et du Conseil National et ses 200 membres élus au suffrage universel pour quatre ans également.

Au niveau des partis politiques, on distingue principalement le Parti Populaire Suisse, le Parti Social-Démocrate, le Parti Chrétien Démocrate et le Parti Écologique.

Le principe du secret bancaire suisse

Presque aussi connu que son chocolat, le secret bancaire de la Suisse possède une réputation internationale. Son fonctionnement est très simple : il oblige légalement les banques (et leurs employés) à ne dévoiler aucune information sur l’identité de leurs clients. Cette mesure s’applique également aux filiales de banques étrangères installées en Suisse.

En 1931, alors que le secret bancaire est officieusement mais largement pratiqué, Jean-Marie Musy (alors Conseiller Fédéral) a ainsi déclaré lors de l’Assemblée Générale des banquiers suisses :

« Le contrôle officiel de la banque n’est désirable ni pour l’État, ni pour la banque [...] L’intervention des contrôleurs officiels inquiéterait [...] la clientèle qui attache une très grande importance à la discrétion sur laquelle elle veut pouvoir compter. La fuite des capitaux déposés dans nos banques, qui pourrait être la conséquence de l’institution du contrôle officiel, causerait à notre économie nationale un mal dont le peuple tout entier aurait à souffrir. »

L’histoire du secret bancaire

Le principe du secret bancaire est pour la première fois inscrit dans la Loi en 1934 et aurait été destiné à protéger les émigrés juifs quittant l’Allemagne des organismes nazis. Des sanctions lourdes étaient alors prévues pour les banques ne le respectant pas. La première évolution du texte de Loi est effective de nombreuses années plus tard, en 1980, et constitue un premier pas vers la coopération de la Suisse sur le plan de la criminalité internationale via la Loi fédérale d’assistance mutuelle en matière criminelle. Il était alors possible, pour les problèmes d’extradition, de passer outre le secret bancaire. En 1998, presque 20 ans plus tard, la Suisse améliora à nouveau la transparence du secret bancaire concernant les affaires de blanchiment d’argent, tout en préservant l’anonymat de ses clients en règle. En 2005, le pays a signé un nouveau traité pour améliorer toujours plus la lutte contre la criminalité. Cependant, la Suisse n’a jamais privilégié la coopération internationale à la qualité de son secret bancaire, toujours actif.

Les exceptions au secret bancaire

Si le secret bancaire existe toujours en Suisse, il est cependant très important de savoir qu’il ne protège pas de la justice, nationale comme internationale. En effet, le secret bancaire est levé en cas d’affaire criminelle ou pénale et d’enquête, de quelque degré que ce soit, auprès d’un client d’une banque suisse. Le secret bancaire est également effacé si un juge étranger réalise une enquête en Suisse.