Creating a company in United Kingdom

Incorporation time: 2 days

Incorporation time: 2 days Shelf companies: Yes

Shelf companies: Yes Accounting: Yes

Accounting: Yes

Secretary: Yes

Secretary: Yes Nominee Shareholder: Yes

Nominee Shareholder: Yes Nominee director: Yes

Nominee director: Yes

TAX: 19%

The Country

The United Kingdom is one of the oldest constitutional monarchies in the world, and is located northwest of Western Europe. Its capital, London, is the leading financial centre of Europe and one of the most influential cities in the world. Formerly a colonial empire, the country still has 14 overseas territories, and was the birthplace of the industrial revolution. Today, the United Kingdom is the world’s seventh largest economy.

An onshore centre

The United Kingdom is the best place to setup onshore/offshore entities and to benefit from a tax of approximately 5% through a holding company. It is very simple to create a company in the United Kingdom, thanks to Common Law jurisdiction and relatively low management fees.

The preferred type of onshore company is the Limited Company, which when combined with the UK Agency system, makes it possible to transfer maximum earnings towards the company. The advantages of the United Kingdom are that for offshore entities, corporate income tax can be reduced to 4%, and VAT does not apply. Furthermore, the country’s excellent reputation is beneficial for brand image.

Useful information

London is the number one financial capital in the world. It is part of Europe, and presents every possible advantage, including a low tax rate of 3%, thanks to the Agency Agreement. The United Kingdom offers the best possible market conditions, and therefore represents the best jurisdiction for all commercial, negotiation and service operations

.The various types of companies

Creating a company in the United Kingdom requires 6 procedures and 2 days.

| Types of companies | French Translation | Capital | Number of partners |

|---|---|---|---|

| Limited Company (LTD) | Société à responsabilité limitée privée (SARL) | 1 GBP | No minimum, liability limited to capital |

| Public Limited Company (PLC) | Société à responsabilité limitée publique | Minimum of £50,000, 25% of which must be paid up upon being formed | No minimum, liability limited to capital |

| Limited Partnership (LLP) | Partenariat limité | No minimum capital | Minimum of 2 partners, limited liability |

| Partnership | Partenariat | No minimum capital | Minimum of 2 partners, unlimited joint and several liability |

| Private Company | Société à responsabilité illimitée | No minimum capital | No minimum, joint and several liability |

Limited Company (LTD)

The LTD is the most common type of company in the United Kingdom. It provides a flexible structure and is quick to create; it also makes it possible to transfer shares or bring in other investors or shareholders. The company may be owned by legal or natural persons, and can therefore be controlled by an offshore company, which makes it possible to pass on 95% of revenue (Agency Agreement).

Public Limited Company (PLC)

The PLC is a company with a single partner and shareholder, and cannot include any others. It is generally used by craftsmen and retail shops, but only infrequently for trade with foreign countries.

The Limited Partnership (LLP)An LLP is a partnership which takes the form of a company having two partners governed by a contract. These partners are either natural persons, or two offshore companies. This type of company has no units or shares, but is instead an equal partnership. It is impossible to bring in another party, or to transfer shares or units. The LLP structure usually consists of two offshore companies, located for example in Belize and the British Virgin Islands, or in Hong Kong and Gibraltar if the company is more conscious of brand image.

Different tax rates

Corporate tax is 28%, except for small businesses with an annual income of less than 300,000 GBP, in which case the tax rate is reduced to 21%. This income tax applies to all British companies; however, credits are issued when taxes are paid abroad.

Income is taxed between 21% and 28%. Commercial expenses or charitable contributions may be deducted from overall income.

Other taxes are also applicable to businesses, such as national insurance contribution (NIC), vehicle licenses, and council tax. In terms of consumer goods, value added tax (VAT) is applied, up to a rate of 20%. VAT is 5% for certain goods and services, and does not apply to water, pharmaceuticals, newspapers, books and social services.

Finally, personal income tax is determined on a progressive scale :

| Tax Bracket (GBP) | Tax |

|---|---|

| 0 to 2,440 | 10 % |

| 2,441 to 37,400 | 20 % |

| 37,401 to + | 40 % |

Personal allowances, professional expenses and certain share plans, retirement or savings plans can be deducted from taxes. France and the United Kingdom have signed two Double Tax Avoidance Agreements, in 1963 and 2004.

Links : HM Revenue and Customs (HMRC) Tax informationAccounting Overview

It is possible to use International Accounting Standards in the United Kingdom, and to benefit from similar treatment as applied to companies that file using UK GAAP (Generally Accepted Accounting Practices).

British businesses must keep accounting records, in which all operations are included, as well as annual financial statements consisting of an annual report, a profit and loss statement, a balance sheet, a statement of cash flows, notes, an opinion from the auditors, an analysis of recorded profit and loss, a comparison of the changes in shareholders’ equity, and a note stating that income has been recorded on the basis of historical cost.

Financial statements must also be filed annually. External auditors must also carry out an annual audit of the company.

Liens :The Institute of Chartered Accountants in England and Wales

Association of Chartered Certified Accountants

Chartered Institute of Public Finance and Accountancy

The British agricultural sector represents only 1% of national GDP, but remains very active and produces large amounts of potatoes, beets, wheat and barley. Animal husbandry is also an important aspect of the agricultural sector. The country has extensive natural resources, and was once the 10th largest oil producer; national companies BP and Shell are leaders in the petroleum industry.

Industry, on the other hand, is not a very competitive sector, although high-tech industry is relatively dynamic. The service sector is by far the most important sector in the country, and generates three-quarters of the nation’s GDP. Heavily finance focused, the service sector has made London a stock market that rivals New York.

The United Kingdom has a strong international presence in the commercial field, which accounts for 60% of the country’s GDP. The second largest exporter and third largest importer of commercial services, the United Kingdom’s main trading partners are the European Union, the United States and China.

The benefits of investment:

- creating a company does not take long for this part of the world

- tax rates are low

- London is the global leader in financial services

- the capital has been voted the best European city for business

Les points faibles :

- dominance of finance in GDP

- poor quality infrastructure

- strong competition in the industrial sector

Once a foreign company is registered in the United Kingdom, it is considered the same as any other British company. Also, the United Kingdom forcefully defends the rights of its businesses within the European Union.

Access to and functioning of the market

The United Kingdom is a member of the World Trade Organization and the OECD. It is a signatory to the Kyoto Protocol, the Washington Convention, the Montreal Protocol and the 2001 International Coffee Agreement. The country is also a member of the European Union, and therefore benefits from the EU’s free trade agreements.

The United Kingdom complies with European Union customs regulations, which, although very liberal, impose a number of restrictions. Farm products have particularly been subject to in-depth inspections following the implementation of the Common Agricultural Policy, whose purpose is to promote European agriculture. GMOs used in products must be indicated on packaging used for imports, and animals that are raised using growth hormones are also prohibited. The import tax applicable to manufactured goods, minerals and metals, is 1.44% for EU members, and 4.2% for foreign countries. This is one of the lowest rates in the world.

In order to import goods into the United Kingdom, exporters must complete an Intrastat declaration. An individual declaration must be completed when the value of goods exceeds 6,000 GBP. In order to comply with the World Customs Organization’s SAFE standards, the EU has implemented the Import Control System since 2011, which aims to further secure the exchange of goods. An Entry Summary Declaration must also be presented to the Customs Office of the country of import.

The United Kingdom’s external trade is primarily ensured by its ports (97%), i.e., 600 million tonnes per year. There are hundreds of ports dotted along the British coastline, and the largest ports are London, Plymouth, Liverpool, Southampton, Aberdeen and Felixstowe. The United Kingdom also has an excellent road network, the use of which has increased since the opening of the European market. And of course, the United Kingdom is linked to the France and the European continent by the channel tunnel, which was completed in 1994.

In the United Kingdom, industry accounts for 26% of GNP, of which engineering, transportation and electronics are the main sectors. Chemical products are also a dominant sector.

Links :The Combined Nomenclature of the European Community

British Ports Association

British Airport Authority (BAA)

Department for Transport

Confederation of British Industry

Employment law

The legal working week in the United Kingdom is 48 hours, and retirement age is set at 60 for women and 65 for men. Employment contracts are governed by law. Minimum wage is EUR 1,105, employer social security contributions amounted to 12.8%, and employee contributions to 11%.

26% of employees are union members, and the main trade unions are the TUC, Amicus and STUC.

Intellectual property

| Type of rights | Text of Act | Validity of protection | Agreements signed |

|---|---|---|---|

| Patents | 1977 Patent law | 20 years | - Patent Cooperation Treaty (PCT) - Strasbourg Agreement Concerning International Patent Classification |

| Trademarks | 1994 Trademark law | 10 years | - Nice Agreement on the International Classification of Goods and Services -The Madrid Agreement Concerning the International Registration of Marks |

| Design | 1949 legislation on registered designs | 5 years | |

| Copyright | 1988 copyright, patents and industrial designs law | 70 years, except in the case of graphic layout, in which case it is 25 years | - Berne Convention for the Protection of Literary and Artistic Works - Convention for the Protection of Producers of Phonograms - Rome Convention for the Protection of Performers - WIPO Copyright Treaty - WIPO Performances and Phonograms Treaty |

World Intellectual Property Organization

Department for Work and Pensions

Political data

Queen Elizabeth II is the head of State and represents executive power. However, this title is primarily symbolic, and the monarch only enjoys the right to be consulted, to advise and to warn the Government. The leader of the party that wins parliamentary elections becomes Prime Minister (currently David Cameron) for a period of 5 years. The Prime Minister is the real head of Government, and holds executive power.

The United Kingdom’s legislature is bicameral, i.e., has two chambers: the House of Lords (upper house) with 625 members elected for life, 92 hereditary peers, and 26 clergy members; and the House of Commons (lower house) which has 646 seats for members elected by universal suffrage for a period of five years.

Le Royaume-Uni compte trois grand partis politiques qui sont le Parti Travailliste (à gauche, attaché aux syndicats), le Parti Conservateur (pro-libre échange) et les Démocrates Libéraux (centristes et pro-européens).

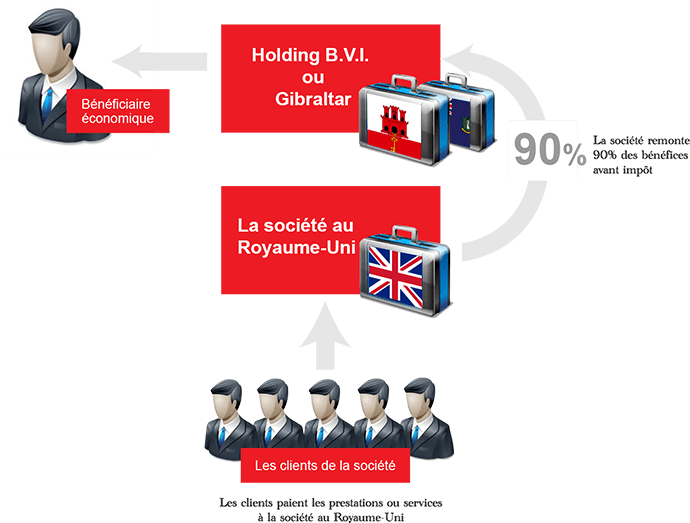

The UK Agency Company

The UK Agency Company or UK Agreement is a simple offshore device to facilitate activities between multiple companies. For example, imagine that an offshore company wants to do business with several clients based in various countries. To facilitate exchanges, the offshore company (called the principal) establishes an onshore company in the United Kingdom (the agent) to carry out trade with the principal’s customers.An agency contract between the two entities is therefore signed, clearly specifying that the British company acts on behalf of the offshore company, and that all trade will be conducted in the agent’s name. Thus, it is the company based in the United Kingdom that will be in contact with clients, issue invoices and receive payments.

Income is then transferred to the offshore company, and therefore taxed according to the legislation of the country of destination. It is important to clarify that the UK onshore company may not exercise an activity in the United Kingdom, failing which its revenues would be subject to British tax law.

The UK Agency Company therefore enjoys the image and ease of exchange offered by the United Kingdom, while taking advantage of the offshore company’s tax benefits, as the offshore company received all revenue. Discover our simulation of the UK Agency Company and other information via our Agency Agreement UK setup.

Diagram of the UK Agency Company

Caution: Caution: the term “offshore setup” may in some cases be considered tax fraud, tax evasion or an abuse of rights. The diagram above may be illegal in some countries, and while it gives a quick overview of international practices, it cannot be considered definitive or applicable on the basis of the illustration presented. If you are interested in such a setup, you must consult a qualified advisor.